The Rising Demand of Financial Offshore Investments Among Affluent Individuals

The Rising Demand of Financial Offshore Investments Among Affluent Individuals

Blog Article

Checking Out the Trick Benefits of Making Use Of Financial Offshore Provider

In the world of international money, the critical use offshore financial solutions provides unique benefits, specifically in the locations of tax optimization and property protection. financial offshore. Territories supplying reduced tax obligation rates and durable privacy laws draw in people and firms alike, seeking to enhance profitability while protecting their wealth. These solutions not just make certain discretion but likewise give a platform for diverse financial investment opportunities that can bring about significant economic development. This expedition increases essential concerns concerning the functional and moral implications of such monetary approaches.

Tax Optimization Opportunities in Offshore Jurisdictions

While discovering economic overseas services, one substantial benefit is the tax optimization possibilities available in overseas territories. Several overseas financial facilities enforce no capital gains taxes, no inheritance tax obligations, and offer low business tax rates.

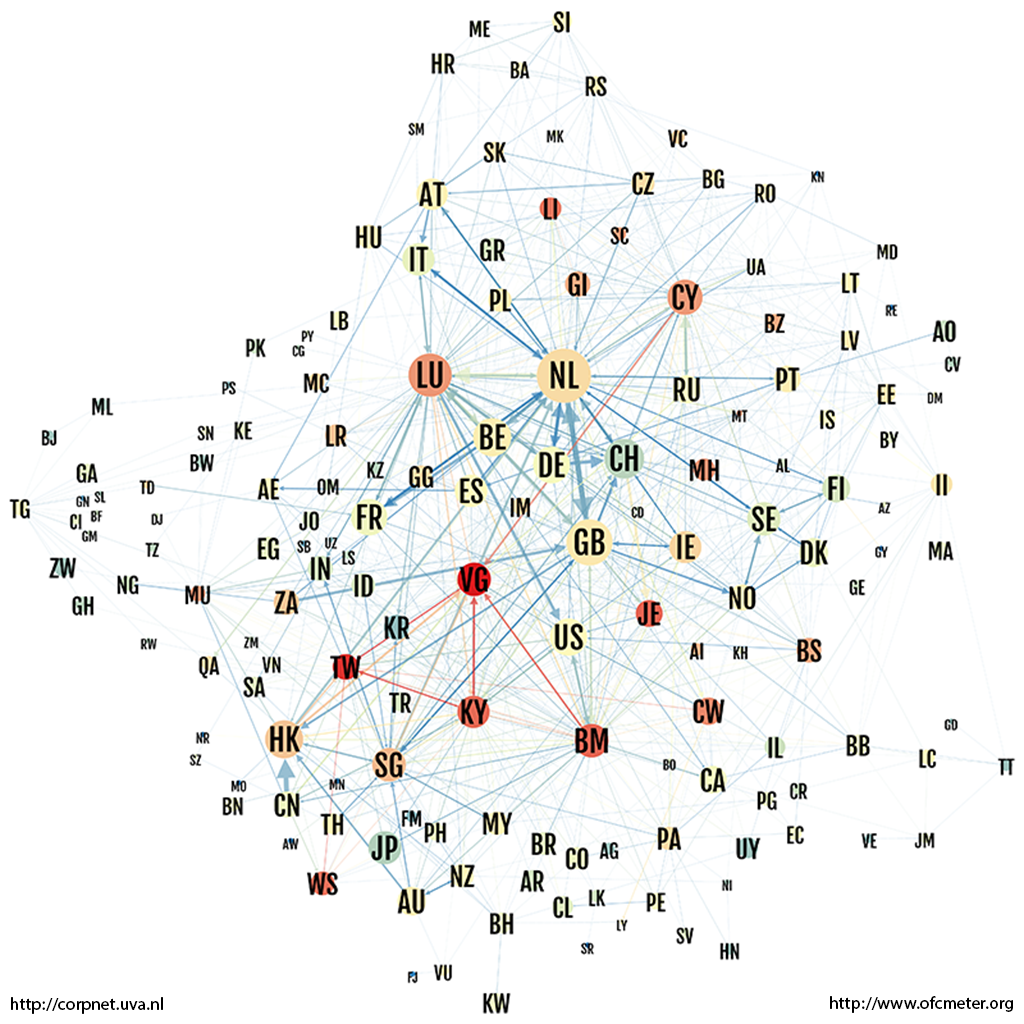

In addition, territories such as the Cayman Islands, Bermuda, and the Island of Man are renowned for their competitive tax obligation regimens. They offer a legal structure that helps with worldwide business procedures without the hefty tax common in the investors' home countries. Using these opportunities needs cautious planning and adherence to worldwide tax obligation regulations to guarantee conformity and take full advantage of benefits, making the expertise of specialized financial experts vital in browsing the complexities of offshore financial activities.

Enhancing Privacy and Possession Protection With Offshore Provider

Numerous people and corporations transform to overseas services not only for tax advantages yet also for improved privacy and asset protection. Offshore jurisdictions usually have stringent confidentiality regulations that stop the disclosure of monetary and personal information to third events. By putting possessions in offshore depends on or business, they can lawfully secure their wide range from lenders, claims, or expropriation.

Diversity and Danger Administration With International Financial Operatings Systems

In enhancement to improving privacy and asset defense, overseas financial solutions offer significant possibilities for diversification and threat administration. By allocating possessions throughout different global markets, financiers can lower the influence of local volatility and additional reading systemic threats. This international spread of financial investments helps reduce possible losses, as adverse financial or political growths in one region might be stabilized by gains in an additional.

Additionally, the use of worldwide financial platforms can use advantageous currency direct exposure, boosting portfolio efficiency with money diversity. This method takes advantage of fluctuations in currency values, possibly balancing out any residential money weaknesses and more maintaining financial investment returns.

Verdict

Finally, financial offshore services existing considerable benefits for both people and businesses by supplying tax obligation optimization, use this link improved personal privacy, property defense, and threat diversification. These solutions promote tactical economic planning and can bring about considerable development and preservation of wealth. By leveraging the one-of-a-kind benefits of overseas jurisdictions, stakeholders can accomplish an extra efficient and secure administration of their financial resources, tailored to their particular demands and purposes.

In the world of international money, the strategic use of offshore financial services offers distinctive benefits, especially in the areas of tax optimization and possession protection.While discovering monetary overseas solutions, one significant advantage is the tax optimization opportunities available in offshore territories. Numerous offshore financial facilities enforce no capital obtains tax obligations, no inheritance taxes, and offer low business tax rates - financial offshore. Utilizing these opportunities calls for cautious preparation and adherence to worldwide tax obligation regulations moved here to make certain conformity and take full advantage of advantages, making the proficiency of specialized financial consultants critical in browsing the intricacies of offshore financial activities

Report this page